Find A Professional

More Items From Ergsy search

-

Can I invest in foreign stocks with an ISA?

Relevance: 100%

-

What types of ISAs can I use for investments?

Relevance: 67%

-

What is an ISA?

Relevance: 59%

-

How does an ISA generate passive income?

Relevance: 57%

-

How much would I need in an ISA to generate £2,000 monthly?

Relevance: 55%

-

Do I need to declare my ISA income on my tax return?

Relevance: 55%

-

Are there fees associated with Stocks & Shares ISAs?

Relevance: 52%

-

What Is An ISA UK (Should I have an ISA & Different Types Of ISAs)

Relevance: 51%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 48%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 48%

-

Can I withdraw money from my ISA any time?

Relevance: 46%

-

What is a realistic rate of return for an investment ISA?

Relevance: 46%

-

Can I transfer my ISA between providers?

Relevance: 41%

-

Is my ISA protected if my provider goes bankrupt?

Relevance: 39%

-

Do online banks offer investment options?

Relevance: 38%

-

Can I have multiple ISAs?

Relevance: 33%

-

How are dividends in an ISA taxed?

Relevance: 33%

-

What happens if I exceed the ISA contribution limit?

Relevance: 30%

-

Are there grants specifically for individuals with disabilities?

Relevance: 28%

-

Can UK citizens work in France or Spain without a visa?

Relevance: 24%

-

Would a wealth tax apply to foreign assets?

Relevance: 24%

-

What is a learning disability?

Relevance: 22%

-

Can children with disabilities access school meals?

Relevance: 20%

-

Helping someone with multiple diabilities

Relevance: 20%

-

Can pension scheme members influence how their pension is managed?

Relevance: 20%

-

Pension UK | SIPPs Explained | Who Are The Best Providers

Relevance: 19%

-

Crypto Scams Exposed - Protect Your Investments Now!

Relevance: 18%

-

Can UK citizens travel to Spain without a visa?

Relevance: 17%

-

Do UK citizens need a visa to travel to France?

Relevance: 17%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 17%

-

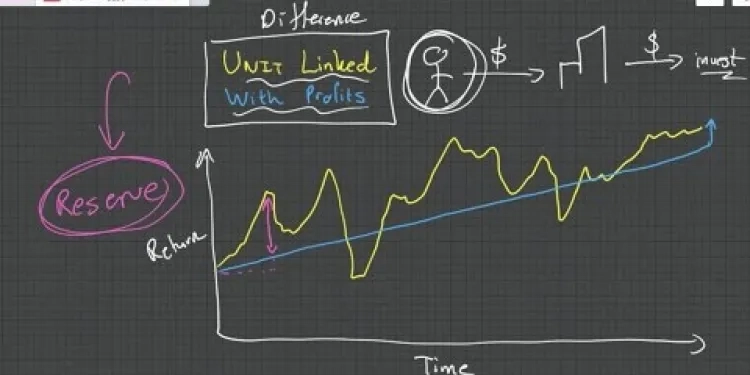

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 16%

-

What Happens To Investments and Pensions | Moving Abroad | Leaving the UK

Relevance: 15%

-

What are the entry requirements for the rest of the Schengen Area?

Relevance: 15%

-

Use of reasonable adjustments to reduce health inequalities for people with a learning disability

Relevance: 14%

-

What is a defined contribution pension scheme?

Relevance: 14%

-

How can individuals protect their retirement savings?

Relevance: 13%

-

How will refunds affect investments towards improving water infrastructure?

Relevance: 13%

-

Flu vaccinations for people with a learning disability

Relevance: 13%

-

What does SEND stand for?

Relevance: 13%

-

Accessing cervical screening with the right support for people with a learning disability

Relevance: 12%

Understanding ISAs

An Individual Savings Account (ISA) is a tax-efficient savings and investment account available to UK residents. It allows individuals to save or invest up to a certain limit each tax year without paying capital gains or income tax on the returns. There are several types of ISAs, such as Cash ISAs, Stocks and Shares ISAs, Innovative Finance ISAs, and Lifetime ISAs. Each serves a distinct purpose and has unique features.

Investing in Foreign Stocks with a Stocks and Shares ISA

A Stocks and Shares ISA is designed for individuals who wish to invest in the stock market. It offers the flexibility to include various investment options, such as individual company shares, bonds, and funds. One common question among investors is whether they can incorporate foreign stocks into their Stocks and Shares ISA portfolio.

The good news is that you can invest in foreign stocks through a Stocks and Shares ISA. This type of ISA allows you to purchase shares listed on international stock exchanges, enabling diversification of your investment portfolio. Trading in international securities can help reduce risks associated with a single market and potentially increase returns by tapping into growth opportunities abroad.

Considerations When Investing in Foreign Stocks

While you can invest in foreign stocks using a Stocks and Shares ISA, there are several considerations to keep in mind. Firstly, not all ISA providers offer international trading capabilities, so you need to confirm with your provider whether they facilitate foreign stock investments. Some platforms provide access to US markets, European exchanges, and other global markets, but availability can vary widely.

Another crucial factor is the fee structure. Investing in foreign stocks may incur additional costs such as currency conversion fees, foreign exchange rate fluctuations, and potentially higher transaction fees compared to UK shares. You should carefully review these costs, as they can impact your overall returns.

It's also important to consider the tax implications of investing in foreign stocks. While gains within the ISA are tax-free, foreign dividends may be subject to foreign withholding taxes, which aren't always reclaimable. Understanding the tax treaties between the UK and the country of investment can provide clarity on potential tax liabilities.

Steps to Invest in Foreign Stocks with an ISA

To invest in foreign stocks using a Stocks and Shares ISA, follow these steps. First, choose an ISA provider that offers access to international markets. Research and compare providers based on fees, available markets, and any additional services they offer. Once you've selected a provider, open or transfer your existing Stocks and Shares ISA if necessary.

Next, research the foreign stocks you are interested in and evaluate them as potential investments. Diversify your holdings to spread risk across different sectors and regions. Finally, monitor your investments regularly to ensure they align with your financial goals and adjust your portfolio as needed.

Understanding ISAs

An Individual Savings Account, or ISA, is a special type of savings account for people living in the UK. It helps you save money without having to pay certain taxes. There are different kinds of ISAs like Cash ISAs and Stocks and Shares ISAs. Each one works in a special way and has different benefits.

Investing in Foreign Stocks with a Stocks and Shares ISA

A Stocks and Shares ISA is for people who want to invest in the stock market. You can buy shares from different companies, bonds, and funds. Many people wonder if they can buy stocks from other countries with their Stocks and Shares ISA.

The good news is yes, you can buy foreign stocks! This means you can have shares from companies all around the world. Having stocks from different countries can make your investments safer and might help you earn more money.

Considerations When Investing in Foreign Stocks

There are some things to think about when buying foreign stocks. Not all ISA providers let you trade in other countries, so you need to check if yours does. Some might let you trade in the US or Europe, but you should make sure.

Also, check the costs. Buying foreign stocks might mean paying extra fees. You might pay for changing money to another currency or for bigger charges than usual. These can affect how much money you make.

Think about taxes too. Inside an ISA, your gains are tax-free, but foreign companies might keep some of your dividends as tax. Find out about tax rules between the UK and the other country to understand what taxes you might owe.

Steps to Invest in Foreign Stocks with an ISA

Here’s how to invest in foreign stocks with a Stocks and Shares ISA. First, find an ISA provider that lets you buy stocks in other countries. Check different providers to see the fees and what markets they offer. Open or move your ISA to them if needed.

Next, learn about the foreign stocks you want to buy. Make sure you have a mix of stocks from different places and types. This helps spread the risk. Keep track of your investments to make sure they are helping you reach your money goals. Change your investments if you need to.

Frequently Asked Questions

Can I invest in foreign stocks with an ISA?

Yes, you can invest in foreign stocks through an ISA, typically via a Stocks and Shares ISA.

What is a Stocks and Shares ISA?

A Stocks and Shares ISA is a type of Individual Savings Account that allows you to invest in a range of assets including stocks, shares, funds, and more, with tax advantages.

Are there any restrictions on which foreign stocks I can invest in with an ISA?

There could be restrictions depending on the ISA provider, but generally, most major international exchanges are accessible.

How do currency fluctuations affect my investments in foreign stocks within an ISA?

Currency fluctuations can affect the value of your investments, as changes in exchange rates might increase or decrease the value of foreign stocks.

Are there additional fees for investing in foreign stocks through an ISA?

Yes, there may be additional fees such as foreign exchange fees or transaction fees when investing in foreign stocks through an ISA.

Can I hold foreign currency in my ISA?

Generally, ISAs are denominated in GBP, so foreign transactions are converted to GBP, and you cannot hold foreign currencies directly.

Do foreign dividends affect my ISA?

Dividends from foreign stocks can be paid into your ISA, usually converted to GBP, and are generally tax-free within the ISA.

Can I invest in US stocks through my ISA?

Yes, most ISA providers allow you to invest in US stocks as part of a Stocks and Shares ISA.

Is it tax-efficient to hold foreign stocks in a Stocks and Shares ISA?

Yes, investments within a Stocks and Shares ISA are sheltered from capital gains tax and income tax on dividends.

What happens if a foreign stock I hold in an ISA pays a dividend in a foreign currency?

The dividend will typically be converted to GBP before being credited to your ISA account.

Do I need to report foreign stocks held in my ISA on my tax return?

No, income and gains within an ISA do not need to be reported on your UK tax return.

Can I invest in emerging markets through an ISA?

Yes, many ISA providers offer access to emerging markets through funds or ETFs listed on international stock exchanges.

Are there any specific rules for investing in European stocks within an ISA?

The rules for investing in European stocks are similar to those for other international investments, depending on your ISA provider.

How do ISA annual limits apply to foreign stock investments?

The annual contribution limit for ISAs applies to all investments, including foreign stocks, not just to UK stocks.

What are the risks of investing in foreign stocks with a Stocks and Shares ISA?

Risks include currency risk, political risk, and market volatility, which can all affect the value of your investments.

Can I transfer foreign stocks to another ISA if I change providers?

Yes, you can transfer the stocks to a new ISA provider, but the process may involve selling and repurchasing the stocks.

What documentation do I need to invest in foreign stocks through a Stocks and Shares ISA?

You need to have an ISA account set up with a provider offering foreign stocks, and you may need to complete additional forms for international investments.

Are there benefits to investing in foreign stocks within an ISA compared to a standard brokerage account?

The main benefit is the tax advantages, as gains and dividends on ISA investments are tax-free.

Can I mix UK and foreign stocks in a single Stocks and Shares ISA?

Yes, you can hold a mix of UK and foreign stocks in a single ISA, subject to the offerings of your provider.

Do ISA providers offer research and analysis on foreign stocks?

Many ISA providers offer research tools and analysis for international markets, but this varies by provider.

Can I buy stocks from other countries with an ISA?

Yes, you can! An ISA is like a special box for saving money. You can use it to buy stocks from other countries. Stocks are pieces of a company that you can buy.

If you need help, you can ask an adult or use special apps. These can make it easier to buy and see how your stocks are doing.

Yes, you can buy shares from other countries using an ISA. This is usually done with a Stocks and Shares ISA.

What is a Stocks and Shares ISA?

A Stocks and Shares ISA is a special account. You can put money in it. This money can be used to buy shares and stocks. Stocks and shares are parts of companies you can own. This account helps you save money on taxes.

Here is how it works:

- You put money in the ISA account.

- You use this money to buy shares and stocks.

- You don’t pay as much tax on the money you make.

If you want help, you can:

- Ask an adult to explain it to you.

- Use pictures or videos to learn more.

- Talk to a friendly bank worker who can help you.

A Stocks and Shares ISA is a special savings account. You can use it to buy things like stocks, shares, and other investments. The good part is that you get some tax benefits too.

Can I buy any foreign stocks with an ISA?

There might be some rules set by the ISA provider. But usually, you can use most big international exchanges.

How do changes in money value affect my foreign stock investments in an ISA?

When you buy stocks from another country, the value of their money can go up or down. This can make your investment worth more or less.

Here is what you can do to help:

- Use a currency converter to see how much your money is worth in another country.

- Ask an adult you trust, like a parent or teacher, to help you understand.

- Watch videos or read simple guides about money changes and investments.

Money in different countries can go up or down in value. This is called currency change. It can change how much your investments are worth. If you have stocks from other countries, they might be worth more or less because of these changes.

Do I have to pay extra money to buy foreign stocks in an ISA?

Yes, there might be extra costs when you invest in stocks from other countries through an ISA. These costs can include money exchange fees or transaction fees.

Can I keep other countries' money in my ISA?

Most ISAs use British pounds (GBP). When you buy something in a different country's money, it gets changed into GBP. You can't keep other countries' money in an ISA.

Do money from other countries affect my ISA?

When you get money from shares in other countries, this money is called dividends. If you have an ISA (a special savings account), this money can go into it. The money is changed into British pounds (GBP). In the ISA, you usually do not have to pay tax on this money.

If you find reading hard, you can ask someone to explain it to you. You can also use tools that read the text aloud, like screen readers, or use picture-based explanations. These can make understanding easier.

Can I buy US stocks with my ISA?

Yes, you can use a Stocks and Shares ISA to buy US stocks. Most ISA providers let you do this.

Should I keep foreign stocks in a Stocks and Shares ISA?

When you buy stocks from other countries, it’s important to know if you can save money on taxes. A Stocks and Shares ISA can help with this.

Here’s what you need to know:

- An ISA helps you save money without paying some taxes.

- When you buy foreign stocks, you might still have to pay some taxes to those countries.

- It's good to ask a financial advisor if buying foreign stocks in an ISA is a good choice for you.

Remember, using simple language tools or asking for help from someone who understands finance can be useful too.

Yes, when you put money in a Stocks and Shares ISA, you don’t have to pay extra taxes on the money you make. This means no tax on the extra money your investments earn, and no tax on the money you get from companies you invest in.

What if a foreign company I own in an ISA gives me money in a different currency?

If you own shares from another country in your ISA, they might give you money called a dividend.

This money could be in a different currency, not pounds (£).

Here’s what usually happens:

- The bank changes the foreign money into pounds (£).

- You get the money in your ISA in pounds (£).

Helpful tips:

- Use a currency converter online to understand how the value changes.

- Ask an adult to help if you find it tricky.

The money you get from your stocks will usually be changed into British pounds (GBP) before it goes into your ISA account.

Do I have to tell the tax people about shares in other countries kept in my ISA?

If you have shares from other countries in your ISA, you might wonder if you need to report them when you pay your taxes. Here's what you need to know:

- An ISA is a special account where you can save money, and it has some tax benefits.

- If the shares are kept in an ISA, usually, you do not need to report them on your tax return.

- It’s always a good idea to check the rules or ask for help if you’re not sure.

- You can ask a grown-up or use a tax helpline to get more advice.

No, you do not have to tell the UK tax office about income or money you make inside an ISA.

Can I use an ISA to invest in new countries?

Yes, many companies that provide ISAs let you invest in new markets. You can do this by using funds or ETFs on international stock markets.

Are there special rules for buying European stocks in an ISA?

Yes, there are some rules you need to know when buying European stocks in an ISA. An ISA is a special account where you can save or invest money without paying tax. Here are some simple tips:

- You must follow the ISA rules set by the UK government.

- You can only invest in stocks that are allowed in an ISA.

- Check if the European stock you want to buy is on the approved list.

- Remember, you have a limit on how much money you can put in your ISA each year.

If you need help, ask a grown-up or use apps and videos that explain investing. They can make it easier to understand!

The rules for buying European stocks are like the rules for buying stocks from other countries. This depends on who helps you with your ISA savings account.

What are the rules for ISA savings limits when buying stocks from other countries?

You can put money in an ISA each year. This limit is for all your investments. It includes shares from other countries, not just shares from the UK.

What could go wrong if I buy stocks from other countries with a Stocks and Shares ISA?

There are some risks when you invest. These risks can change how much your money is worth. The risks are:

1. **Currency risk**: This means money from different countries can change in value.

2. **Political risk**: This means changes in government or laws can affect your money.

3. **Market volatility**: This means the market, where people buy and sell investments, can go up and down a lot.

You can use tools like a dictionary to help understand these words better. Talking to someone who knows about investing can also help.

Can I move my foreign stocks to a new ISA if I switch providers?

Yes, you can move your stocks to a new place. But, you might have to sell them first and then buy them again.

What papers do I need to buy stocks from other countries with a Stocks and Shares ISA?

If you want to buy stocks from other countries using a Stocks and Shares ISA, you need to have some papers ready. Here is what you might need:

- Your ID, like a passport or driver's license.

- Proof of where you live, like a bill with your address on it.

- Your National Insurance Number. This is a special number for taxes.

If you have trouble with paperwork, you can ask a family member, friend, or a helper you trust to help you. They can help you understand the steps.

You need to have a special savings account called an ISA. This account should be with a company that lets you buy stocks from other countries. You might also have to fill out extra forms to buy stocks from other countries.

Is it good to buy stocks from other countries in an ISA instead of a regular account?

When you buy stocks from other countries, you can choose to do it in an ISA or a regular account.

ISA Benefits:

- Tax-Free: You might not need to pay tax on the money you make.

- Safe for Savings: An ISA can help you save money for the future.

Regular Account:

- If you use a regular account, you might pay more taxes.

- You need to check what taxes you have to pay.

Remember:

- Ask an adult if you need help.

- You can use apps to help you learn about stocks.

- Read more if you want to know more about ISAs.

The best thing about an ISA is that you don't have to pay tax on the money you make from it. This includes any extra money you get, like gains or dividends.

Can I put UK and foreign stocks in one Stocks and Shares ISA?

Yes, you can have both UK and foreign stocks in one ISA. Check what your provider offers.

Do ISA providers give information about foreign stocks?

An ISA provider is a company that helps you save and invest your money. Sometimes people want to know about stocks from other countries. Stocks are pieces of a company you can buy.

If you want to know if an ISA provider can help you learn about these stocks, you can ask them. They might have information and research that you can read.

If reading is hard, ask someone you trust to help you understand the information better. You can also use tools like audiobooks or text-to-speech apps to help you listen to the information instead of reading it.

Many places where you can save money, like an ISA, give you tools to learn about markets in other countries. But, what they offer can be different from place to place.

Some helpful tips:

- Ask someone you trust to help you understand.

- Use simple apps or websites that explain things clearly.

- Look for videos or pictures that explain how markets work.

Useful Links

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Can I invest in foreign stocks with an ISA?

Relevance: 100%

-

What types of ISAs can I use for investments?

Relevance: 67%

-

What is an ISA?

Relevance: 59%

-

How does an ISA generate passive income?

Relevance: 57%

-

How much would I need in an ISA to generate £2,000 monthly?

Relevance: 55%

-

Do I need to declare my ISA income on my tax return?

Relevance: 55%

-

Are there fees associated with Stocks & Shares ISAs?

Relevance: 52%

-

What Is An ISA UK (Should I have an ISA & Different Types Of ISAs)

Relevance: 51%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 48%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 48%

-

Can I withdraw money from my ISA any time?

Relevance: 46%

-

What is a realistic rate of return for an investment ISA?

Relevance: 46%

-

Can I transfer my ISA between providers?

Relevance: 41%

-

Is my ISA protected if my provider goes bankrupt?

Relevance: 39%

-

Do online banks offer investment options?

Relevance: 38%

-

Can I have multiple ISAs?

Relevance: 33%

-

How are dividends in an ISA taxed?

Relevance: 33%

-

What happens if I exceed the ISA contribution limit?

Relevance: 30%

-

Are there grants specifically for individuals with disabilities?

Relevance: 28%

-

Can UK citizens work in France or Spain without a visa?

Relevance: 24%

-

Would a wealth tax apply to foreign assets?

Relevance: 24%

-

What is a learning disability?

Relevance: 22%

-

Can children with disabilities access school meals?

Relevance: 20%

-

Helping someone with multiple diabilities

Relevance: 20%

-

Can pension scheme members influence how their pension is managed?

Relevance: 20%

-

Pension UK | SIPPs Explained | Who Are The Best Providers

Relevance: 19%

-

Crypto Scams Exposed - Protect Your Investments Now!

Relevance: 18%

-

Can UK citizens travel to Spain without a visa?

Relevance: 17%

-

Do UK citizens need a visa to travel to France?

Relevance: 17%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 17%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 16%

-

What Happens To Investments and Pensions | Moving Abroad | Leaving the UK

Relevance: 15%

-

What are the entry requirements for the rest of the Schengen Area?

Relevance: 15%

-

Use of reasonable adjustments to reduce health inequalities for people with a learning disability

Relevance: 14%

-

What is a defined contribution pension scheme?

Relevance: 14%

-

How can individuals protect their retirement savings?

Relevance: 13%

-

How will refunds affect investments towards improving water infrastructure?

Relevance: 13%

-

Flu vaccinations for people with a learning disability

Relevance: 13%

-

What does SEND stand for?

Relevance: 13%

-

Accessing cervical screening with the right support for people with a learning disability

Relevance: 12%