Find A Professional

More Items From Ergsy search

-

Are there different types of hip implants?

Relevance: 100%

-

Student Finance: Should I pay more? | Plan 1 & Plan 2 | SF Explained

Relevance: 95%

-

Can funeral directors offer payment plans?

Relevance: 80%

-

Planning for your funeral

Relevance: 78%

-

How will the changes in pension age affect retirement planning?

Relevance: 78%

-

What is an asthma action plan?

Relevance: 74%

-

How can individuals protect their retirement savings?

Relevance: 71%

-

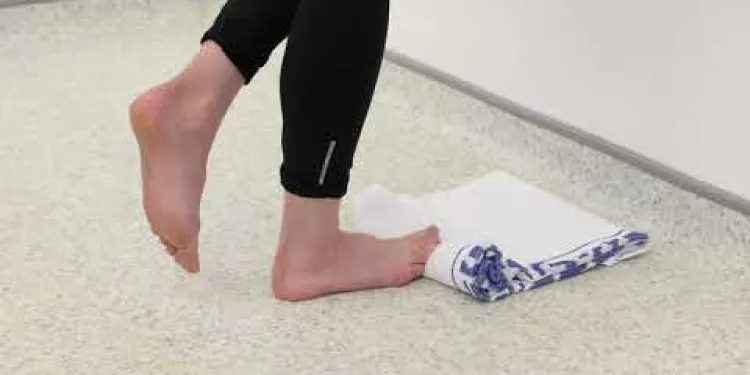

Plantar fasciitis

Relevance: 58%

-

Bernard's Story - Lung Transplant

Relevance: 57%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 57%

-

Who will be affected by the state pension age changes in 2026?

Relevance: 54%

-

Cornea transplant - Your journey

Relevance: 53%

-

Liver transplant - Patient experience - Part 1 (Colin)

Relevance: 53%

-

Liver transplant - Patient experience - Part 2 (Lynne)

Relevance: 53%

-

Record Number of Brits Embrace Plant-Based Diets for Wellbeing

Relevance: 53%

-

Patient Stories - Having a kidney transplant

Relevance: 52%

-

Having a kidney transplant

Relevance: 52%

-

Plantar fasciitis

Relevance: 51%

-

Cornea transplant patient Information

Relevance: 49%

-

Police Pension Explained

Relevance: 47%

-

What is a defined contribution pension scheme?

Relevance: 47%

-

Plantar Fascia Wall Stretch

Relevance: 46%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 46%

-

Plantar Fascia Cold Therapy

Relevance: 44%

-

Plantar Fascia Loading Exercise (High Load Exercise)

Relevance: 40%

-

What is the new planned state pension age after 2028?

Relevance: 38%

-

What is the state pension age in the UK in 2026?

Relevance: 37%

-

How long do hip replacement implants last?

Relevance: 36%

-

Matthew's Story: Kidney Transplant - Part 1

Relevance: 36%

-

When will the state pension age increase to 67?

Relevance: 35%

-

Do all plants produce pollen that causes hay fever?

Relevance: 34%

-

Kidney transplant waiting stories – DJ Ace and Lauren | NHS Organ Donation

Relevance: 34%

-

Heart-lung transplant patient shares her story

Relevance: 33%

-

What are the state pension age changes in 2026 in the UK?

Relevance: 31%

-

How does climate change affect pollen levels?

Relevance: 31%

-

What role does government regulation play in protecting pensions?

Relevance: 31%

-

Is nettle rash related to nettle plants?

Relevance: 29%

-

Teachers Pension Explained | All you need to know | Final Salary & Career Average Earnings

Relevance: 28%

-

Harshi’s learning disability annual health check and health action plan

Relevance: 28%

-

Planned caesarean section

Relevance: 28%

Introduction to Pension Age Changes

The pension age in the UK is undergoing significant transformations, reflecting broader demographic and economic changes. As the state pension age increases, individuals are facing new challenges and opportunities in planning for retirement. Understanding these changes is crucial for effective retirement planning.

The Current State Pension Age

Traditionally, the state pension age in the UK has been 65 for men and 60 for women. However, recent reforms have gradually equalized the pension age for both genders and further increases are scheduled. As of 2023, the state pension age is 66 for both men and women, with plans to increase it to 67 by 2028 and 68 by 2046.

Impact on Retirement Planning

Increasing the pension age means individuals need to reassess their retirement timelines. Traditionally, many planned to retire at the official pension age, but now, with a longer wait for state benefits, more personal savings or extended working are necessary. This change impacts financial planning and employment decisions significantly.

Financial Implications

With the state pension beginning later, individuals must ensure they have sufficient savings to cover any gap period between their desired retirement age and the age they begin receiving the state pension. This may involve increased contributions to personal or workplace pensions, or investing in alternative savings vehicles like ISAs.

Extended Career Planning

For many, the shift in pension age means longer careers. This could require further investment in professional development to remain competitive in the job market or to shift careers if one's current occupation becomes untenable due to age-related challenges.

Effects on Lifestyle and Health

Longer working lives can affect personal health and lifestyle plans. Individuals might need to balance work with maintaining health, managing stress, and ensuring they remain physically and mentally fit for extended employment. Planning for a phased retirement, where work hours gradually decrease, could be beneficial.

Opportunities from Delayed Retirement

On the positive side, delayed retirement can lead to increased savings, due to prolonged income and potentially higher final pension pots. There’s also the opportunity to pursue fulfilling second careers or part-time work that aligns with personal interests.

Advice for Future Planning

Given these changes, it’s crucial for individuals in the UK to frequently review and adjust their retirement plans. Consulting with financial advisors, reevaluating investment strategies, and staying informed about policy changes will ensure a more secure retirement. Engaging with employer pension schemes and taking advantage of any governmental advice services is recommended.

What is Changing About Pensions

Pensions in the UK are changing a lot. This is because the country and the economy are changing too. The age when you get your pension is going up. This means people need to think differently about when and how they stop working. Knowing about these changes helps you plan better for when you retire.

How Old Do You Have to Be Now?

Before, men got their pension at 65 years old and women at 60 years old. Now, both men and women get their pension at 66. This will go up to 67 by 2028 and then 68 by 2046. The government decided to make these changes to the pension age.

How It Affects Your Retirement Plans

Because the pension age is going up, people need to think again about when they want to stop working. Many people used to stop working when they got their pension. Now, they might have to save more money or keep working longer. This is important for how you plan your money and decide when to stop working.

How It Affects Your Money

If you have to wait longer to get your pension, you need to make sure you have enough money saved. You might need to save more money or put more money into a personal or work pension. Some people might use other ways to save money like ISA accounts.

Working Longer

Because of changes to the pension age, some people will work longer. This means learning new skills so you can keep up with job changes. Sometimes, you might also want or need to find a different kind of job that suits you better as you get older.

How It Affects Your Life and Health

Working longer can change how you live and how healthy you feel. It is important to take care of your health and manage stress. Staying active and healthy helps you keep working. You might choose to work fewer hours as you get older to make this easier.

Good Things About Working Longer

There are good things about working longer, too. You can save more money because you earn longer. You might have more money in your pension when you finally retire. You also get the chance to try different jobs or hobbies that you enjoy.

What You Should Do Next

With these changes, it is important to look at your plans for the future often. It helps to talk to someone who knows a lot about money, like a financial advisor. Checking how you save and knowing what the rules are will help you plan better for retirement. Join work pension schemes and listen to advice from the government for more help.

Frequently Asked Questions

What are the recent changes in pension age?

Recent changes in pension age refer to adjustments in the age at which individuals can begin to claim their pension benefits. These changes can vary by country and may involve gradual increases over several years.

Why is the pension age changing?

The pension age is changing primarily due to increased life expectancy and the strain on public pension systems. Governments aim to ensure the sustainability of pension funds by adjusting the eligibility age.

How will a higher pension age impact my retirement planning?

A higher pension age means you will need to plan for a longer working life and possibly save more independently to cover the period between retirement and the new pension eligibility age.

Will I need to work longer due to changes in pension age?

Yes, if the pension age increases, you may need to work longer before you can claim pension benefits unless you have sufficient savings to retire earlier.

Can I still retire early if the pension age goes up?

You can retire early if you have enough private savings or other sources of income. However, you might not receive government pension benefits until reaching the new pension age.

How do changes in pension age affect early retirement benefits?

Changes in pension age can mean reduced early retirement benefits, as the age to receive full benefits increases, potentially resulting in smaller payments if you take them early.

Should I adjust my savings plan due to changes in pension age?

Yes, it may be wise to increase your savings rate or adjust your investment strategy to account for potential longer working years and delayed pension benefits.

Will changes in pension age affect the amount of pension I receive?

The changes typically affect when you can start receiving your pension, but not directly the amount. However, claiming early or delayed retirement might impact the total received.

How can I prepare for changes in pension age?

Review and adjust your retirement plan, increase savings, and consider alternative retirement income sources. Stay informed about policy changes that might affect your plans.

What happens if I have already planned for retirement under the old pension age?

You may need to reevaluate your retirement strategy. Consider additional savings or adjusting your retirement age to align with the new pension eligibility age.

Will my private pension be affected by changes in the state pension age?

Private pensions are generally not directly affected by changes in state pension age, but your overall retirement plan may need adjustment to account for changes in income timing.

Can I still receive other benefits if I retire before the new pension age?

Eligibility for other benefits such as social security or unemployment varies by region and personal circumstances. Check local regulations for precise information.

How can I use a financial advisor in light of these changes?

A financial advisor can help reassess your retirement goals and strategy, taking into account the new pension age, to optimize your savings and investment plans.

Should changes in pension age affect my investment strategy?

Potentially, yes. Longer time to accumulate wealth and changing retirements goals might require a shift in your investment strategy, such as asset allocation adjustments.

How often is the pension age likely to change?

Pension age changes are typically gradual and governments usually announce them well in advance, but the frequency can depend on demographic and economic factors.

Do the pension age changes affect everyone equally?

Not always, as the impact can vary based on factors like career length, life expectancy, and private savings. Lower-income groups might face greater challenges.

What's the rationale behind linking retirement age with life expectancy?

Linking retirement age with life expectancy aims to balance the time spent in work and retirement, addressing the financial pressures on pension systems due to people living longer.

What should younger workers do to adapt to future potential pension age changes?

Younger workers should focus on building a robust personal savings plan, staying informed, and being flexible with their retirement planning to adapt to future changes.

Will increasing pension age solve pension funding issues?

While it can alleviate some pressure, increasing the pension age is only one of several measures needed to ensure long-term sustainability of pension systems.

How can lifelong learning and skill development help in the context of increased pension age?

Lifelong learning and skill development can help prolong careers, enhance employability at older ages, and facilitate transitions to less physically demanding roles.

What are the new rules for pension age?

The pension age is the age when people can start to get their pension money.

Recent changes mean this age might be different now.

It is important to check what the new pension age is.

You can ask someone to help you or use online tools to find out.

Recent changes in pension age mean when people can start getting their pension money is changing. This can be different in each country. The age might go up slowly over a few years.

Why is the age for getting a pension changing?

The age to get a pension is going up. This means people have to wait longer to stop working and get money for being retired.

There are a few reasons for this change:

- People are living longer now, so they need money for more years.

- The government wants to make sure there is enough money for everyone who needs a pension.

Here are some ways to learn more:

- Ask someone you trust to explain it to you.

- Use a computer or a tablet to find easy videos that talk about pensions.

The age when people can get their pension is changing. This is because people are living longer, and it costs more to pay everyone. Governments want to make sure there is enough money for pensions in the future. So, they are raising the age when people can start getting their pension.

What happens to my retirement plans if the pension age goes up?

When the pension age goes up, it means you have to wait longer to get your pension money.

This change might mean you need to save more money for your retirement or work longer.

Here are some things that might help:

- Talk to a money expert. They can help you plan.

- Use online tools to see how much money you might need.

- Think about saving a little extra each month.

- Check if you can get any help or support from your work or the government.

If you have to wait longer to get your pension, you might have to work for more years. You may also need to save more money by yourself for when you stop working. This is because there might be more years before you can get your pension money.

To help with this, you can use tools like a savings app. You can also talk to someone who knows a lot about money, like a financial planner.

Do I need to work more years because of changes in pension age?

Pension age means the age when you can stop working and get money for being older.

If the government changes this age to be older, you might have to work more years before you can stop and get your pension.

If you find reading hard, try using a dictionary or ask someone to explain.

If the age for getting a pension goes up, you might have to work longer before you can get your pension money, unless you have enough savings to stop working sooner.

Can I stop working early if the age for getting a pension gets higher?

You can stop working early if you have saved enough money or have other ways to get money. But, you might have to wait to get money from the government until you are older.

What happens to early retirement money when pension age changes?

When the age to get your full pension goes up, it might mean you get less money if you stop working early. If you use your pension before the new, higher age, you might get smaller payments.

Should I change how I save money because the age for getting my pension is different now?

Here is what you should think about:

- Find out the new age when you can start getting your pension.

- See if you need to save money for longer because of this change.

- Think about talking to a money expert for advice.

Some helpful tools:

- Use a calculator to see how much money you will need.

- Write down your money goals and check them often.

- Ask someone you trust to help you plan your savings.

Yes, it might be a good idea to save more money or change how you invest. This can help if you end up working more years or get your pension money later.

Here are some things that can help:

- Use a savings app to keep track of your money.

- Ask a family member or friend to help you with saving and investing.

- Watch videos about saving and investing to learn more.

Will changing the age for getting my pension change how much money I get?

The changes usually affect when you can start getting your pension money, but they do not change how much you get. Still, if you choose to get your pension early or late, it might change the total amount in the long run.

How can I get ready for changes in pension age?

Getting ready for changes in pension age can help you feel better about the future. Here’s how you can prepare:

- Find out: Look up when you can get your pension. This might be changing, so it’s good to know.

- Plan ahead: Think about how you will save money until you reach pension age. You might need to save more now.

- Talk to someone: It can be helpful to talk to a financial advisor. They can give you advice and tips.

- Use tools: Online tools and calculators can show you how much money you might need. They can help you plan your savings.

By doing these things, you will be more ready for when the pension age changes.

Look at your plan for when you stop working and make changes if you need to. Try to save more money. Think about other ways to get money when you retire. Keep up to date with any rule changes that might change your plans.

What should I do if I planned to retire at the old age?

If you want to retire, but the rules have changed, don't worry. Here’s what you can do to make it easier:

- Check the New Rules: Find out what the new retirement age is.

- Talk to an Expert: Speak to someone who knows about pensions. They can help you plan.

- Think About Saving: Try to save a little more money if you can.

- Ask for Help: You can ask a family member or a friend to help you understand.

These steps can help you feel better and plan your retirement well.

It's a good idea to think again about your retirement plan. You might need to save more money or change the age you want to retire. This will help you match the new age when you can get your pension.

Try using a simple calculator or talking to someone who plans money to help you understand better.

Will my private pension change if the state pension age changes?

Private pensions usually do not change when the age for getting the state pension changes. But you might need to change your retirement plan because the time you get money might be different.

Can I get other money help if I stop working before pension age?

If you stop working before you reach the age to get a pension, you might still get other money help. Here are some tips:

- Check what benefits you can get - there might be different ones for you.

- Ask someone for help if you find it hard to understand. This can be a friend, family member, or an advice service.

- You can also use websites that have simple information about money help.

Always ask questions if you’re not sure about something. There are people who want to help you.

If you want to know if you can get money help, like social security or unemployment, it depends on where you live and your situation. Look at the rules near you to find out more.

How can I get help from a money expert with these changes?

A money helper (financial advisor) can talk with you about your plans for when you stop working (retirement). They can help you make a new plan for your savings and money based on the new rules for when you can get your pension (pension age). This can help you save money the best way.

Should I change how I save money if the age I get a pension changes?

If the age when people can get a pension changes, you might wonder if you should change how you save money.

What You Can Do:

- Talk to a money expert. They can help you understand what to do.

- Look at what you are saving now and see if you need to save more.

- Think about different ways to save your money.

It can be helpful to use money apps or calculators to keep track of your savings.

Maybe, yes. You have more time to save money, and your goals for retirement might change. You might need to change how you invest your money, like choosing different places to put your money.

Try using a calculator to help figure out how much money you need. Ask someone you trust for advice, and write your goals down so you know what you are aiming for.

How often might the age for getting a pension change?

Changes to the age you can get your pension often happen slowly. Governments usually tell people about these changes a long time before they happen. How often they change depends on things like how many people there are and the economy.

Do the Pension Age Changes Affect Everyone the Same Way?

The age when people get their pension might change. This can be different for different people.

Here are two tips to help understand:

- Ask for help: If you are unsure, talk to someone you trust.

- Use pictures: Look for charts or pictures that can make things clearer.

No, it is not the same for everyone. It can be different depending on things like how long someone works, how long they live, and how much money they have saved. People who earn less money might have a harder time.

Why do we connect retirement age with how long people live?

When you retire depends on how long people are living. This helps make sure people have time to both work and enjoy retirement. It also helps manage money for pensions because people are living longer now.

What can young workers do if pension ages change in the future?

1. **Learn about pensions:** Find out what a pension is and how it helps you when you are older.

2. **Save money:** Try to save a little money each month. It will help you in the future.

3. **Ask for help:** Talk to someone who knows about pensions. They can give good advice.

4. **Stay informed:** Keep learning about changes to pensions. This way, you won’t be surprised.

5. **Use tools:** There are online calculators that can help you understand pensions. Ask someone to show you how to use them.

Younger people who work should try to save money. It's good to learn about money and be ready to change their plans for when they stop working one day.

Will raising the age for getting a pension fix money problems?

Raising the age when people can get their pension can help a little bit. But we also need to do other things to keep pension systems working well for a long time.

Helpful Tips: - Read Slowly: Take your time to understand each word. - Use a Dictionary: If you don't know a word, look it up or ask someone to explain it. - Break it Down: Split sentences into smaller parts if that helps.How can learning new things and building skills help when people have to work longer before retiring?

People are working for more years before they can retire and rest.

Learning new things and getting better at skills can help a lot.

Here are some simple ways how:

- Stay Useful: When you learn new skills, you stay good at your job. This can help you keep your work for longer.

- Feel Better: Learning new things can make you feel happy and smart. It is fun to know more.

- Get New Jobs: If you need to find a different job, new skills can help you get new kinds of work.

Here are some ways to help while learning:

- Use Videos: Watching videos can make learning easier and more fun.

- Practice: Doing things again and again helps you remember.

- Take Breaks: Resting between learning can help you think better.

Learning new things all the time can help you work longer. It can also make it easier to get jobs when you're older. Learning can help you move to jobs that are not so hard on your body.

Here are some tips to help you learn:

- Use drawings and pictures to understand things better.

- Ask someone to help explain things if you're stuck.

- Take breaks when learning new things so you don't get tired.

- Try learning apps and games to make it more fun.

Useful Links

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Are there different types of hip implants?

Relevance: 100%

-

Student Finance: Should I pay more? | Plan 1 & Plan 2 | SF Explained

Relevance: 95%

-

Can funeral directors offer payment plans?

Relevance: 80%

-

Planning for your funeral

Relevance: 78%

-

How will the changes in pension age affect retirement planning?

Relevance: 78%

-

What is an asthma action plan?

Relevance: 74%

-

How can individuals protect their retirement savings?

Relevance: 71%

-

Plantar fasciitis

Relevance: 58%

-

Bernard's Story - Lung Transplant

Relevance: 57%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 57%

-

Who will be affected by the state pension age changes in 2026?

Relevance: 54%

-

Cornea transplant - Your journey

Relevance: 53%

-

Liver transplant - Patient experience - Part 1 (Colin)

Relevance: 53%

-

Liver transplant - Patient experience - Part 2 (Lynne)

Relevance: 53%

-

Record Number of Brits Embrace Plant-Based Diets for Wellbeing

Relevance: 53%

-

Patient Stories - Having a kidney transplant

Relevance: 52%

-

Having a kidney transplant

Relevance: 52%

-

Plantar fasciitis

Relevance: 51%

-

Cornea transplant patient Information

Relevance: 49%

-

Police Pension Explained

Relevance: 47%

-

What is a defined contribution pension scheme?

Relevance: 47%

-

Plantar Fascia Wall Stretch

Relevance: 46%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 46%

-

Plantar Fascia Cold Therapy

Relevance: 44%

-

Plantar Fascia Loading Exercise (High Load Exercise)

Relevance: 40%

-

What is the new planned state pension age after 2028?

Relevance: 38%

-

What is the state pension age in the UK in 2026?

Relevance: 37%

-

How long do hip replacement implants last?

Relevance: 36%

-

Matthew's Story: Kidney Transplant - Part 1

Relevance: 36%

-

When will the state pension age increase to 67?

Relevance: 35%

-

Do all plants produce pollen that causes hay fever?

Relevance: 34%

-

Kidney transplant waiting stories – DJ Ace and Lauren | NHS Organ Donation

Relevance: 34%

-

Heart-lung transplant patient shares her story

Relevance: 33%

-

What are the state pension age changes in 2026 in the UK?

Relevance: 31%

-

How does climate change affect pollen levels?

Relevance: 31%

-

What role does government regulation play in protecting pensions?

Relevance: 31%

-

Is nettle rash related to nettle plants?

Relevance: 29%

-

Teachers Pension Explained | All you need to know | Final Salary & Career Average Earnings

Relevance: 28%

-

Harshi’s learning disability annual health check and health action plan

Relevance: 28%

-

Planned caesarean section

Relevance: 28%