Find A Professional

More Items From Ergsy search

-

Inflation Hits New High: How Shoppers Are Coping

Relevance: 100%

-

Why do interest rates rise and fall?

Relevance: 57%

-

Government Support Schemes for Families Affected by Inflation

Relevance: 40%

-

How can individuals protect their retirement savings?

Relevance: 28%

-

UK House Prices Fall for Third Consecutive Month

Relevance: 21%

-

How to take someone's blood pressure

Relevance: 20%

-

Rise in Food Bank Usage Amid Economic Challenges

Relevance: 13%

-

Why do pension funds go bust?

Relevance: 11%

-

Teachers Pension Explained | All you need to know | Final Salary & Career Average Earnings

Relevance: 11%

-

Drawdown vs Annuities | Pensions UK | Which Is Better?

Relevance: 11%

-

Impact of Cost of Living on UK Communities

Relevance: 10%

-

Unfreezing the Truth The UK's Frozen Pensions

Relevance: 10%

-

Heart stents

Relevance: 9%

-

Major Banks Announce Changes in Interest Rates: Are You Affected?

Relevance: 9%

-

How does the PPF determine the amount of compensation?

Relevance: 8%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 8%

-

What is a defined benefit pension scheme?

Relevance: 7%

-

Intro to Angiograms, Angioplasty & Coronary Bypass Grafting

Relevance: 6%

-

Understanding the Impact of Rising Living Costs on Family Welfare

Relevance: 6%

-

Impact of Rising Energy Costs on Family Budgets

Relevance: 6%

-

How do interest rate changes affect my mortgage payments?

Relevance: 6%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 6%

-

Should you Pay down your Residential Mortgage?

Relevance: 6%

-

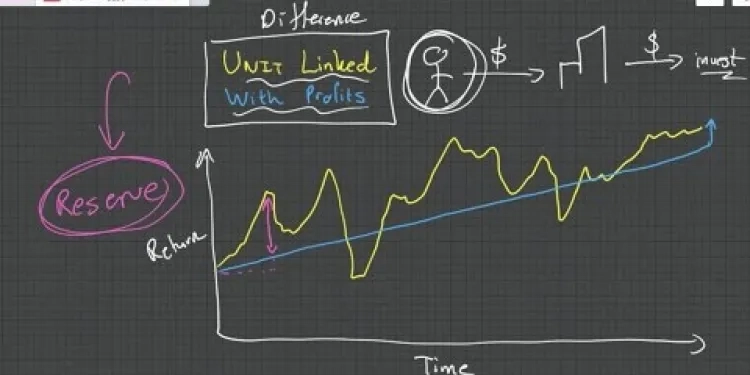

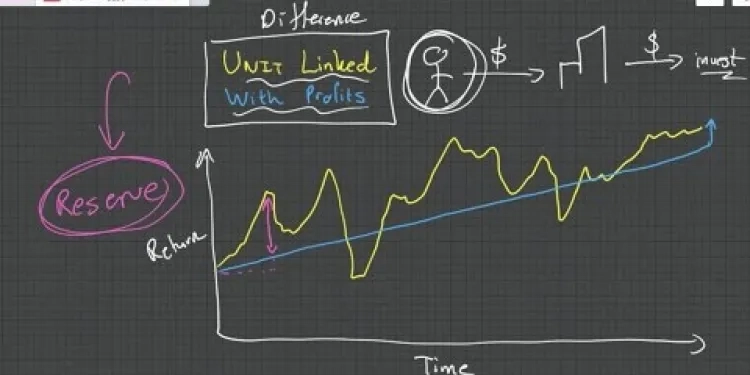

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 6%

-

Seven Reaasons For Measuring blood pressure

Relevance: 6%

-

State Pension UK | How much will I get? | WILL IT LAST FOREVER?!?

Relevance: 5%

-

What is the £500 cost of living payment?

Relevance: 4%

-

How much money can I receive from the Sure Start Grant?

Relevance: 4%

-

Short Films About Mental Health - Personality Disorders

Relevance: 4%

-

Addressing the Cost of Living Crisis: Community Support and Resources

Relevance: 4%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 4%

-

Who is eligible for Household & Cost-of-Living Support grants?

Relevance: 4%

-

Who is eligible for Household & Cost-of-Living Support grants?

Relevance: 4%

-

What are Household & Cost-of-Living Support grants?

Relevance: 4%

-

A guide to hospital-acquired deep vein thrombosis and pulmonary embolism

Relevance: 4%

-

Chancellor's New Budget: What It Means for Your Wallet

Relevance: 4%

-

Can I receive this payment alongside other cost of living payments?

Relevance: 4%

-

What happens during a colonoscopy?

Relevance: 4%

-

Why are council burial fees going up nearly 50% in the UK?

Relevance: 4%

-

Do I need to pay tax on the £500 cost of living payment?

Relevance: 4%

Understanding the Inflation Surge

Inflation in the UK has reached unprecedented levels, impacting consumers nationwide. Various factors such as supply chain disruptions, rising energy costs, and labor shortages have converged to propel prices upward. The Consumer Price Index (CPI) has reported a significant increase, leading to higher costs for essentials like food, fuel, and housing. As the economic landscape shifts, consumers are feeling the pinch of rising living expenses.

Impact on Daily Expenses

With inflation affecting a broad range of goods and services, UK households are witnessing increased financial pressure. Essential commodities such as groceries have seen price hikes, with staples like bread, milk, and vegetables becoming more expensive. Fuel prices have also surged, affecting both transportation costs and utility bills. As a result, families are forced to reassess their spending habits and budgets.

Strategies for Coping

In response to mounting costs, shoppers are adopting various strategies to navigate the challenging economic climate. One notable trend is the shift towards value-oriented shopping. Consumers are increasingly turning to discount retailers and store brands to stretch their budgets further. Many are also utilizing digital tools and apps to track prices and find the best deals.

Meal planning and bulk buying are becoming more common as consumers aim to minimize waste and maximize savings. Additionally, loyalty programs are seeing increased participation, as shoppers seek to benefit from rewards and discounts offered by retailers.

The Role of Technology

Technology is playing a significant role in helping consumers manage the impacts of inflation. Online platforms and mobile applications offer price comparison tools, enabling shoppers to quickly identify cost-saving opportunities. E-commerce has also seen a boost as consumers explore options for buying in bulk or accessing competitive prices from online outlets.

Adapting to a New Normal

Despite the challenges posed by inflation, many UK consumers are finding innovative ways to cope. Community support networks and social media groups are springing up, where individuals share tips on saving money and managing household budgets effectively. These forums have become valuable resources, offering collective wisdom and support during tough times.

Looking Ahead

As the UK continues to grapple with inflationary pressures, the outlook remains uncertain. Economists and policymakers are closely monitoring the situation, with potential interventions on the horizon to stabilize the economy. For now, consumers are advised to stay informed, plan ahead, and utilize available resources to navigate the ongoing financial challenges.

Understanding the Inflation Surge

Prices in the UK are going up a lot and very fast. This is called inflation. Things like problems getting goods delivered, high energy costs, and not enough workers are making prices rise. The Consumer Price Index (CPI) shows that prices for things we need every day, like food, fuel, and housing, are higher. Because of this, people are finding it harder to pay for things.

Impact on Daily Expenses

Inflation is making life more expensive for families in the UK. Things we need every day, like groceries, are costing more. Basic items like bread, milk, and vegetables are now more expensive. The cost of fuel for cars and home bills has gone up too. Because of these changes, families have to think again about how they spend their money.

Strategies for Coping

People are finding ways to deal with higher costs. Many are choosing to shop at discount stores and buy store brand items to save money. Using apps and online tools to find the best prices helps too. Planning meals and buying in large amounts to save money and waste less is also popular. Loyalty programs that give rewards and discounts are being used more and more.

The Role of Technology

Technology helps people handle the effects of rising prices. Online and mobile tools let people compare prices and find good deals fast. More people are shopping online to buy in large amounts or find better prices on the internet.

Adapting to a New Normal

Despite the higher prices, people in the UK are finding new ways to manage. There are groups and social media pages where people share tips to save money and manage their budgets. These communities are helpful for getting advice and support.

Looking Ahead

Prices may keep changing in the future, and things could stay uncertain for a while. Experts are watching closely and might take steps to help. For now, it’s good to stay informed, plan your spending, and use resources like these groups and tools to help manage the costs.

Frequently Asked Questions

What are the main reasons for the current high inflation?

High inflation can be attributed to a combination of factors including supply chain disruptions, increased consumer demand post-pandemic, rising energy costs, and expansive monetary policies.

How are shoppers adjusting their budgets due to inflation?

Shoppers are adjusting by prioritizing essential purchases, seeking discounts and deals, switching to cheaper brands, and reducing discretionary spending.

Which goods and services are most impacted by inflation?

Food, energy (gas and electricity), housing, and transportation are among the most impacted sectors.

How can consumers save money during high inflation periods?

Consumers can save money by creating a strict budget, using coupons and discounts, buying in bulk, and finding alternative options for expensive goods.

Are there any government programs to help consumers cope with inflation?

Governments may offer subsidies, tax breaks, or direct financial assistance to help consumers cope, though specifics vary by country.

How does inflation affect purchasing power?

Inflation reduces purchasing power as the value of money decreases, meaning consumers need more money to buy the same goods and services.

What is core inflation, and how is it different from headline inflation?

Core inflation excludes volatile items like food and energy, providing a clearer measure of long-term trends, whereas headline inflation includes all items.

How are retailers responding to inflation?

Retailers may raise prices, reduce product sizes (shrinkflation), or offer promotional deals to maintain sales volume.

What role do central banks play in controlling inflation?

Central banks control inflation primarily through monetary policy, such as adjusting interest rates and regulating the money supply.

Can inflation lead to a recession?

Prolonged high inflation can lead to reduced consumer spending and economic slowdown, potentially triggering a recession if not managed properly.

How does inflation impact personal savings?

Inflation erodes the real value of savings, meaning that money saved today has less purchasing power in the future unless interest rates on savings are higher than inflation.

What strategies are people using to invest during high inflation?

Investors may turn to assets that typically outperform during inflation, such as real estate, stocks, commodities, and inflation-protected securities.

Are luxury goods affected by inflation?

Luxury goods may be less affected as their consumers are less price-sensitive, but there can still be an impact due to increased production and shipping costs.

What is the impact of inflation on wages?

While some wages may rise in response to inflation, they often do not keep pace, leading to a decrease in real income and purchasing power for workers.

How can businesses cope with inflationary pressures?

Businesses can cope by optimizing operations, adjusting pricing strategies, diversifying supply chains, and seeking efficiencies to reduce costs.

What is hyperinflation, and could it happen in this situation?

Hyperinflation is an extreme and rapid rise in prices and is typically caused by monetary oversupply. It is possible if inflation is not controlled, but more common in economies with unstable currencies.

How does inflation influence interest rates?

High inflation often leads central banks to increase interest rates to curb spending, slow down the economy, and control inflation.

Why are energy prices often at the forefront of inflation discussions?

Energy prices directly impact transportation and production costs across industries, making them a significant driver of inflation.

What is 'shrinkflation' and how does it relate to the current situation?

Shrinkflation is when products are reduced in size or quantity while prices remain the same, effectively hiding price increases from consumers.

Are there any long-term effects of sustained high inflation?

Long-term high inflation can lead to reduced investment, economic uncertainty, decreased savings rates, and long-lasting impacts on income and wealth distribution.

Why are prices going up right now?

Here are some reasons why things cost more money:

1. **Money Printing**: When the government prints a lot of money.

2. **Demand and Supply**: More people want to buy things, but there are not enough things to buy.

3. **Higher Costs**: Things needed to make products, like materials or transport, cost more.

4. **World Events**: Big events, like natural disasters or conflicts, can make prices go up.

Here are some tools that can help you understand better:

- Use pictures to show how prices change.

- Watch videos that explain why things cost more.

High inflation means things cost more money. This can happen because of a few reasons:

1. Problems with supply chains: This means it's hard to get things to the stores.

2. More people want to buy things after the pandemic.

3. Energy costs go up, which makes everything else cost more.

4. Governments printing more money.

Here are some ways to learn more and get help:

- Ask someone to explain words you don't understand.

- Use pictures or videos to learn more about inflation.

- You can use text-to-speech tools to read aloud difficult text.

How are shoppers changing their spending because of rising prices?

When prices go up, people have to think about how to use their money. Here is what they may do:

- Spend Less: People might buy fewer things or choose cheaper items.

- Plan Ahead: Making a shopping list can help stick to a budget.

- Look for Sales: Shoppers can find discounts or special offers to save money.

- Use Coupons: Coupons can help pay less for things.

- Track Spending: Writing down what they spend can help keep control.

These tips can help keep spending under control when prices are high.

People who shop are changing how they buy things. They are making sure to buy only what they really need. They look for sales and cheaper prices. They also choose less expensive brands. They are spending less on things they don't really need.

Which things cost more because of inflation?

Some things and services can get more expensive when inflation happens. Inflation means prices go up over time.

Here are some things that might cost more:

- Food: Things like bread, milk, and fruit might cost more.

- Fuel: Gas for cars might become more expensive.

- Clothes: New clothes might cost extra money.

Services can also cost more:

- Going to the doctor might cost more money.

- Getting a haircut or haircut services could be pricier.

Tips to help understand more:

- Use pictures to learn what inflation means.

- Talk to someone who knows about money to get more help.

- Watch videos that explain how money and prices work.

Food, energy, homes, and transport are some of the most affected areas.

How can people save money when prices go up?

Here are some tips to help you spend less money:

- Make a budget: Write down how much you earn and what you spend. This helps you see where your money goes.

- Buy only what you need: Think before you buy. Ask yourself, "Do I really need this?"

- Use shopping lists: Make a list before you go to the store so you only buy what you need.

- Look for discounts and sales: Find things that cost less or are on sale.

- Save energy: Turn off lights and appliances when you're not using them to lower your bills.

Consider tools like:

- A calculator to help with adding and subtracting money.

- Shopping apps that show discounts or deals.

Ask a friend or family member for help if you need it.

You can save money by doing a few things:

- Make a budget and stick to it.

- Use coupons and discounts.

- Buy things in bulk (buy more at once).

- Look for cheaper options instead of expensive ones.

Try using apps or lists to help you remember these steps!

Is there help from the government for people with rising prices?

Rising prices mean things cost more money. The government might have ways to help if you are finding it hard to pay for what you need.

Here is what you can do:

- Check if there are government programs that give money to help pay for things.

- Look for information on government websites or ask someone you trust for help.

- Use tools like money-saving tips to help manage your spending.

Governments might give money or make taxes smaller to help people. How they do this can be different in each country.

What is inflation and how does it change what you can buy?

Inflation is when prices go up. It means you need more money to buy the same things. If prices increase, your money can't buy as much as before.

Use pictures, charts, or simple videos to help understand this better.

Inflation makes money worth less. This means you need more money to buy the same things.

What is core inflation, and how is it different from headline inflation?

What is core inflation?

Core inflation shows the change in the prices of things we buy. It does not count food and energy prices because they can change a lot.

What is headline inflation?

Headline inflation shows the change in the prices of everything, including food and energy.

How are they different?

Core inflation is different because it leaves out food and energy prices to show a steadier change. Headline inflation includes all prices, so it can go up or down quickly.

Helpful tip:

If you find these words tricky, try using tools like picture dictionaries or ask someone to explain it with simple words and examples.

Core inflation doesn't count things like food and energy. This makes it easier to see long-term trends. Headline inflation counts everything.

What are shops doing about rising prices?

Shops might do a few things to keep selling a lot. They might make things cost more money, make packages smaller, or have special sales to give people a better deal.

How do central banks help control rising prices?

Central banks are like big money managers for countries. They make sure prices for things do not go up too fast. This is called inflation.

Here are ways central banks help:

- They set interest rates: Central banks can raise or lower interest rates. Higher rates make borrowing money more expensive, which can slow down spending and help keep prices steady.

- They watch the money supply: Central banks keep an eye on how much money is going around. Too much money can make prices go up. They can adjust things to help balance it out.

If you want help understanding more, you can:

- Talk to someone who knows about money, like a teacher or parent.

- Use pictures or charts to see how inflation works.

Central banks help keep prices from going up too fast. They do this by changing interest rates and controlling how much money there is.

Can Higher Prices Cause a Recession?

When prices go up a lot, it is called inflation. Inflation means things cost more money.

If prices keep going up, people might stop buying things. If people buy less, shops and businesses make less money.

When shops and businesses make less money, they might have to close or fire workers. This can lead to a recession. A recession means the economy is not doing well, and many people might lose their jobs.

To understand inflation and recession better, you can:

- Ask a teacher or a parent to explain.

- Watch simple videos about money and the economy.

- Use apps that explain money in simple words.

When prices keep going up for a long time, people may stop buying as much. This can slow down the economy. If we do not manage it well, it might cause a recession. A recession is when the economy is not doing well and people may lose jobs.

Tools that can help:

- Use a calculator to help understand how much things cost.

- Ask a friend or family member to explain things if they are confusing.

How does inflation affect your savings?

Inflation means things cost more money.

If your savings do not grow, you can buy less with your money.

To help, you can:

- Put money in a savings account with high interest.

- Talk to someone at the bank to help your money grow.

Inflation means that prices go up over time. This makes money worth less in the future. If you save money now, you might not be able to buy as much with it later.

For your savings to grow, the interest rate (extra money the bank gives you) should be higher than inflation (how much prices go up).

Here are some ways to help:

- Talk to an adult about how inflation works.

- Use online calculators to see how money changes over time.

- Ask for help from a bank staff member to understand savings better.

How do people invest their money when prices are going up a lot?

When prices go up, people who invest their money (called investors) might choose different things to put their money in. These things usually do well when prices rise. They are: houses and buildings (real estate), owning parts of companies (stocks), things like gold or oil (commodities), and special kind of savings that keep their value when prices rise (inflation-protected securities).

If you want help understanding this information, here are some tips: ask a friend or family member to explain it, use a dictionary to look up hard words, or find videos that talk about these topics in a simple way.

Do expensive things cost more when prices go up?

When prices go up for most things, we call this inflation. Does it also make fancy, expensive items cost more? Let's explore this question in a simple way.

Helpful Tips:

- Use pictures to understand better.

- Ask someone to explain if you're unsure.

- Practice reading with a friend.

Fancy things might not be affected much because people who buy them don’t worry about price as much. But things could still be affected because it costs more to make them and send them to stores.

How does rising prices affect pay?

Wages might go up when prices go up. But they often don't go up enough. This means people have less money to buy things.

Tools like budgeting apps can help you track your money. Talking to a money advisor can also be helpful.

How can businesses deal with rising prices?

Businesses face challenges when prices go up, which is called inflation. Here are some simple ways they can manage:

- Plan ahead: Think about costs now and in the future. Budget money wisely.

- Spend smart: Only buy what's really needed. Compare prices for the best deals.

- Save money: Keep savings for hard times. This helps if things get more expensive.

- Raise prices carefully: If needed, raise your prices a little, so customers can still afford your product or service.

- Use technology: Tools and apps can help track spending and find cheaper options.

These steps can help businesses to handle higher costs and do well even when prices go up.

Businesses can do well by making things work better, changing prices smartly, using different sources for supplies, and finding ways to spend less money.

What is hyperinflation, and can it happen here?

What does 'hyperinflation' mean? It is when prices go up very fast. This means you need a lot more money to buy things.

Could this happen here? Let's look at what's happening to see if prices might go up a lot.

Tip: If you find reading hard, ask someone to read with you or use a reading app that reads out loud. You can also use pictures to help you understand better.

Hyperinflation means prices go up very fast and by a lot. This usually happens when there is too much money in a country. Hyperinflation can happen if we do not keep a close watch on rising prices. It happens more in countries where money is not stable.

How does rising prices change interest rates?

When prices go up a lot, it is called high inflation. To help with this, banks might make borrowing money more expensive. This makes people and businesses spend less, which can help control prices and slow down the economy.

Why do we talk about energy prices when we talk about inflation?

Energy prices affect how much it costs to make things and move them around. This can make prices go up in many areas. When prices go up like this, it is called inflation.

To better understand, try using tools like picture dictionaries or listening to audio stories. They can make learning easier and more fun!

What is 'shrinkflation' and how does it relate to what's happening now?

'Shrinkflation' is when things you buy, like snacks or drinks, get smaller but the price stays the same.

Right now, you might notice that snacks or cereals have less in the box or bag. This is called 'shrinkflation'. It means you pay the same, but get less. Companies do this to save money when their costs go up.

To help understand: Look at the size of things before you buy. If you have trouble reading or understanding, ask someone you trust to help explain.

Shrinkflation is when things you buy get smaller or have less inside, but the price stays the same. It makes it harder to notice that you're paying more for less.

What happens if prices keep going up for a long time?

When prices go up for a long time, it can cause some problems. People might put less money into businesses. It can make it hard to know what will happen next with money. People might save less. This can make it harder for everyone to earn and keep money.

Here are some tools to help understand this: - Use pictures and charts to see how money and prices change. - Talk to someone about what this means for you and your family. - Use a calculator to see how spending and saving might change.Useful Links

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Inflation Hits New High: How Shoppers Are Coping

Relevance: 100%

-

Why do interest rates rise and fall?

Relevance: 57%

-

Government Support Schemes for Families Affected by Inflation

Relevance: 40%

-

How can individuals protect their retirement savings?

Relevance: 28%

-

UK House Prices Fall for Third Consecutive Month

Relevance: 21%

-

How to take someone's blood pressure

Relevance: 20%

-

Rise in Food Bank Usage Amid Economic Challenges

Relevance: 13%

-

Why do pension funds go bust?

Relevance: 11%

-

Teachers Pension Explained | All you need to know | Final Salary & Career Average Earnings

Relevance: 11%

-

Drawdown vs Annuities | Pensions UK | Which Is Better?

Relevance: 11%

-

Impact of Cost of Living on UK Communities

Relevance: 10%

-

Unfreezing the Truth The UK's Frozen Pensions

Relevance: 10%

-

Heart stents

Relevance: 9%

-

Major Banks Announce Changes in Interest Rates: Are You Affected?

Relevance: 9%

-

How does the PPF determine the amount of compensation?

Relevance: 8%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 8%

-

What is a defined benefit pension scheme?

Relevance: 7%

-

Intro to Angiograms, Angioplasty & Coronary Bypass Grafting

Relevance: 6%

-

Understanding the Impact of Rising Living Costs on Family Welfare

Relevance: 6%

-

Impact of Rising Energy Costs on Family Budgets

Relevance: 6%

-

How do interest rate changes affect my mortgage payments?

Relevance: 6%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 6%

-

Should you Pay down your Residential Mortgage?

Relevance: 6%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 6%

-

Seven Reaasons For Measuring blood pressure

Relevance: 6%

-

State Pension UK | How much will I get? | WILL IT LAST FOREVER?!?

Relevance: 5%

-

What is the £500 cost of living payment?

Relevance: 4%

-

How much money can I receive from the Sure Start Grant?

Relevance: 4%

-

Short Films About Mental Health - Personality Disorders

Relevance: 4%

-

Addressing the Cost of Living Crisis: Community Support and Resources

Relevance: 4%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 4%

-

Who is eligible for Household & Cost-of-Living Support grants?

Relevance: 4%

-

Who is eligible for Household & Cost-of-Living Support grants?

Relevance: 4%

-

What are Household & Cost-of-Living Support grants?

Relevance: 4%

-

A guide to hospital-acquired deep vein thrombosis and pulmonary embolism

Relevance: 4%

-

Chancellor's New Budget: What It Means for Your Wallet

Relevance: 4%

-

Can I receive this payment alongside other cost of living payments?

Relevance: 4%

-

What happens during a colonoscopy?

Relevance: 4%

-

Why are council burial fees going up nearly 50% in the UK?

Relevance: 4%

-

Do I need to pay tax on the £500 cost of living payment?

Relevance: 4%